Homeowner Stimulation Check? The money for struggling homeowners is coming.

The March 2021 US bailout law contained around $ 1.9 trillion in government spending, aimed at reversing the negative economic impacts of the coronavirus pandemic. Most of the measure was a $ 450 billion stimulus package, responsible for the $ 1,400 stimulus checks, the third round of payments since the start of the pandemic. A second key measure was a one-year increase in the child tax credit, increasing it from 50 to 80 percent and sending out the checks before the tax return. Other government measures include federal unemployment insurance, which expires in September, and the federal Centers for Disease Control or Prevention (CDC) eviction moratorium, recently extended until July 31.

A lesser-known but still important piece of legislation was the creation of the Homeowners Assistance Fund (HAF), a government fund to help homeowners struggling with mortgage payments. The fund aims to prevent homeowners from losing their homes due to the economic consequences of the pandemic. According to the Ministry of the Treasury, the fund was created “to prevent mortgage defaults and defaults, foreclosures, loss of utilities or household energy services and the displacement of financially distressed homeowners after January 21, 2020”.

Additionally, the Treasury Department explains how the funds can be spent: “HAF funds can be used to help with mortgage payments, home insurance, utility payments and other specific purposes. The law prioritizes funds for homeowners who have experienced the greatest hardship, leveraging local and national income metrics to maximize impact.

The need for such a fund is clear. In April, the New York Times reported that more than three million households were behind on mortgages. While evictions have been banned by the CDC throughout the pandemic, apparently as a public health measure, when the moratorium ends, thousands of Americans will become homeless overnight. In some ways, foreclosure is a more serious concern than evicting tenants, as potential landlords have typically invested significantly more in the residence they are being evicted from.

To prevent such a disaster, programs such as homeowner assistance funds have been put in place. To claim funds from the HAF, homeowners must submit an application to their state’s housing agency, outlining how the pandemic has affected their ability to make mortgage payments. They must prove that they lost income or a job during the pandemic, and must prove that their income is not disproportionate to the average income in their region.

For more information, the National Council of National Housing Agencies has a compensation page liaise with each state’s housing agency for assistance in applying.

Trevor Filseth is a current affairs and foreign affairs writer for The national interest.

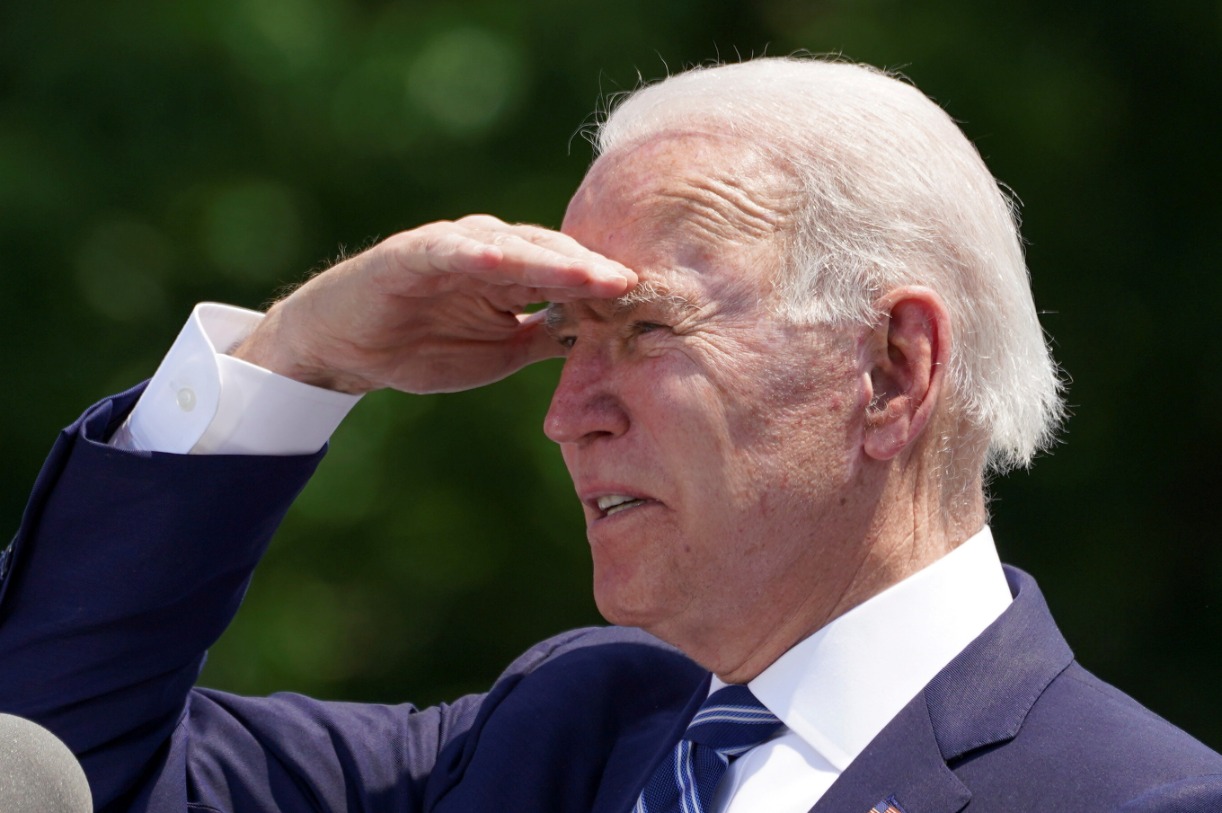

Image: Reuters